Seize is an AI-powered financial management app designed for Indian students in the US to proactively manage their credit card debt.

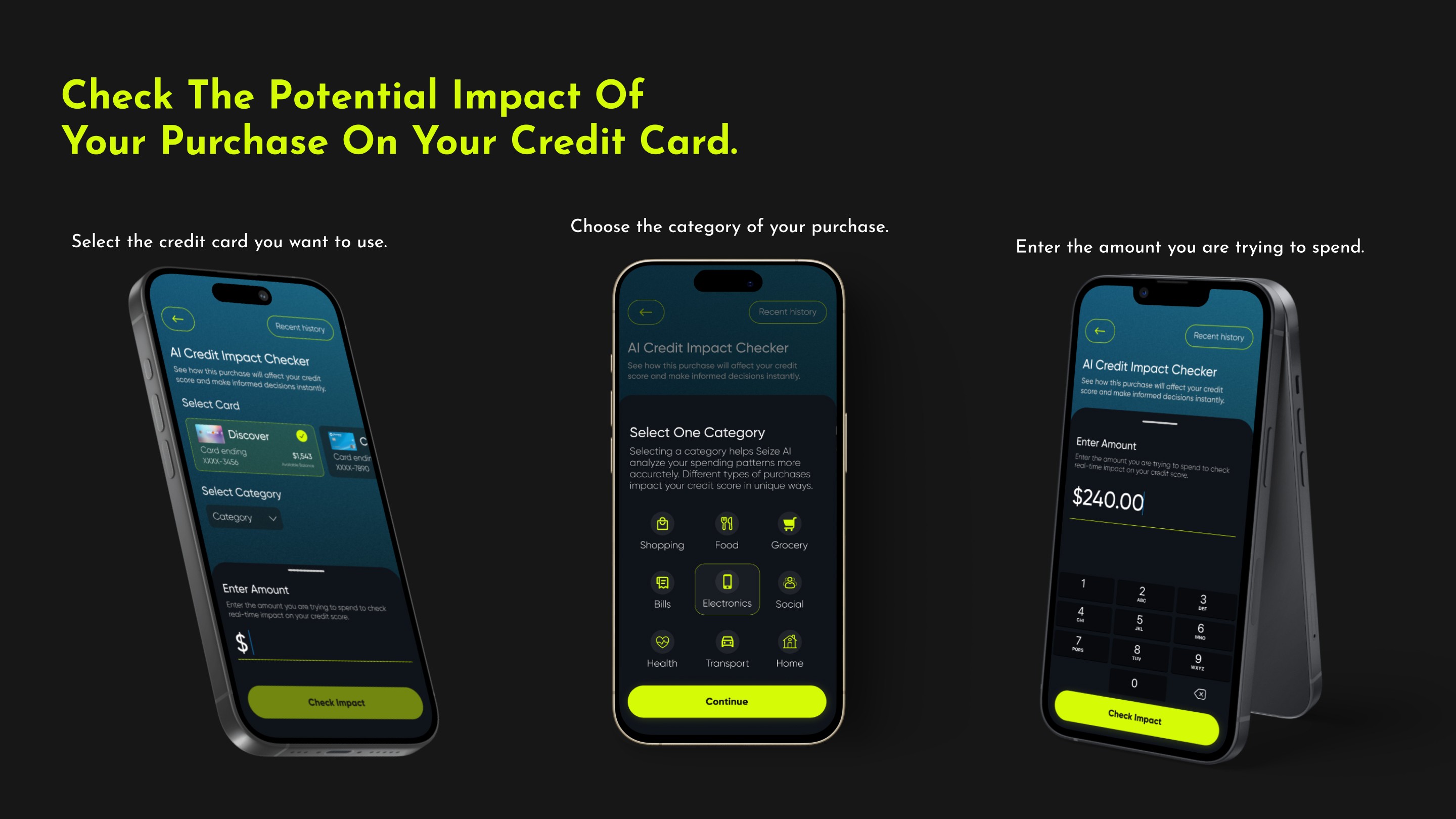

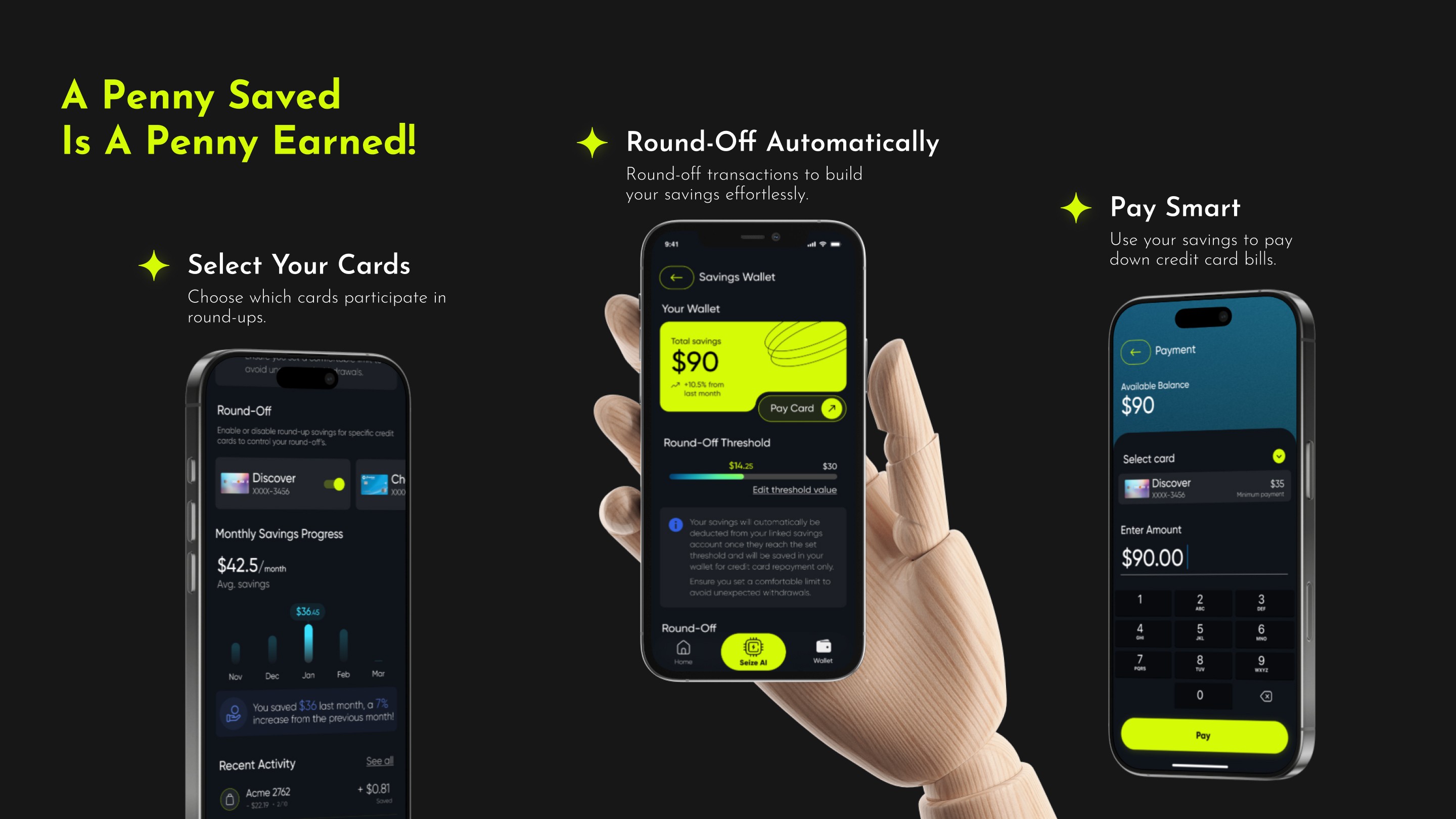

It offers real-time insights into how every purchase affects your credit score, empowering users to make informed spending decisions. By using innovative features such as predictive credit impact analysis and automated round-up savings, Seize helps users build a healthier credit history.

I served as the sole product designer, leading the entire design process—from research and concept to final implementation—creating a solution that truly stands out.

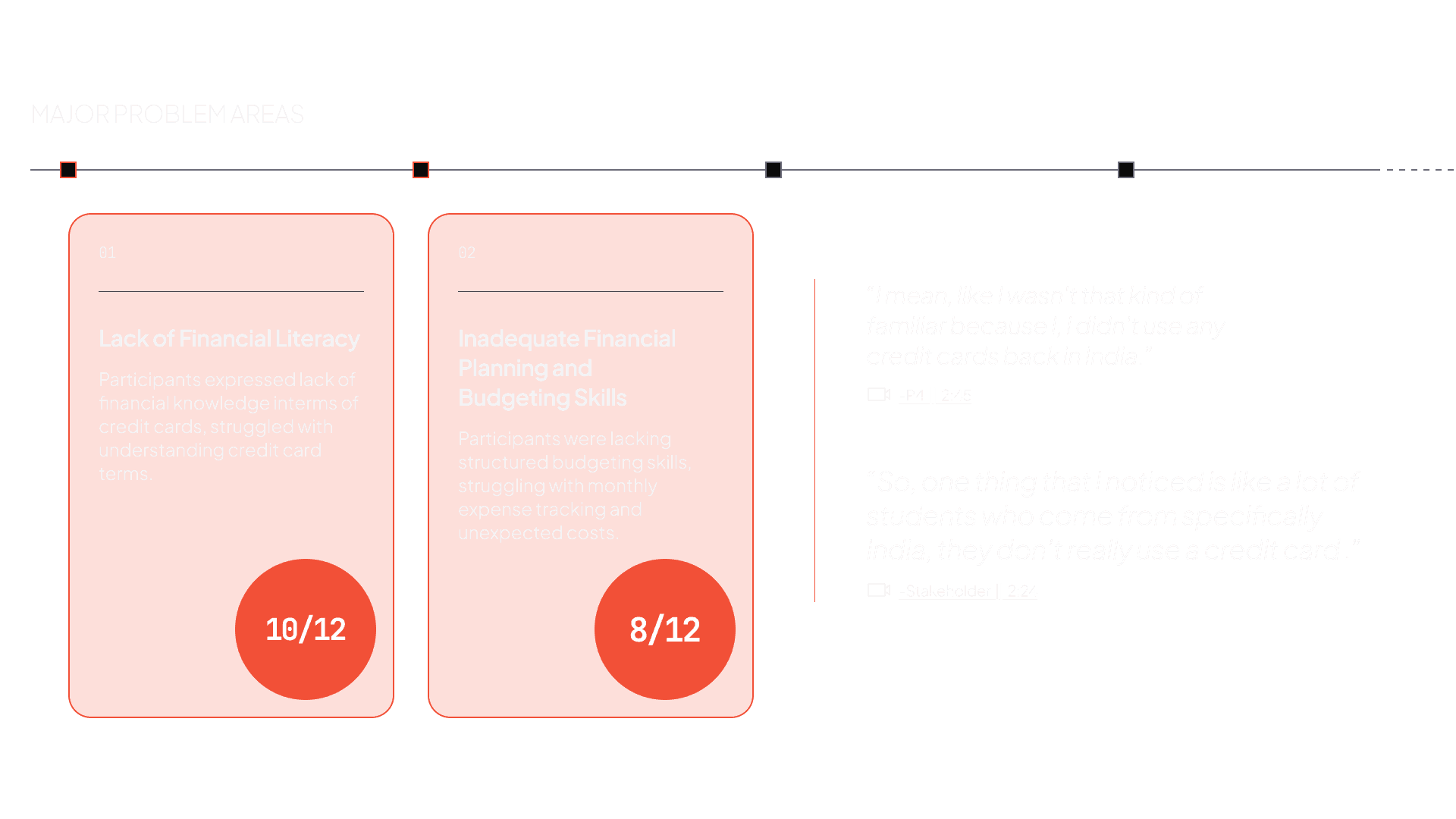

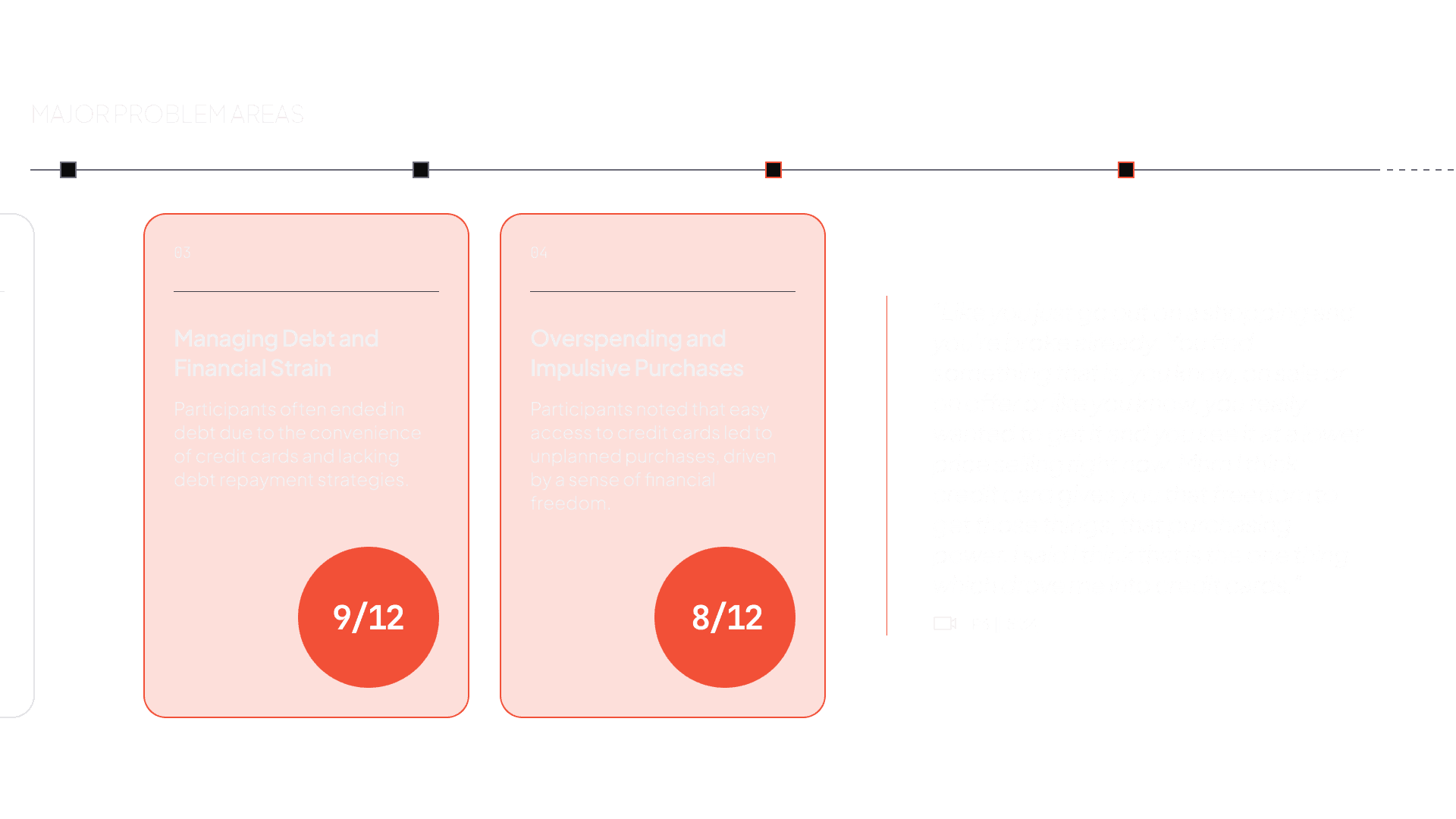

International students, especially those from India, arrive in the US with limited experience in managing credit. The unfamiliarity with the US credit system, combined with new financial responsibilities, often leaves them unprepared for credit management challenges. Without proper tools or guidance, these students can quickly find themselves overwhelmed by credit card debt and financial strain.

These students accumulate significant credit card debt without having any concern because they rely on uncertain future income to manage their finances. The absence of real-time insights into how each transaction impacts their credit score prevents them from making smart financial decisions, ultimately hindering their ability to build a robust credit history and achieve long-term financial stability.

To address this challenge, Seize introduces an AI-based credit management tool with three core features: a real-time Impact Checker that forecasts score changes before a transaction, a Round-Up Savings Wallet that passively collects spare change to pay down debt, and Smart Nudges that offer tailored tips and warnings at the point of decision. Together, these tools shift users from reactive debt tracking to proactive financial control.

Before interacting with the actual user, I began searching for resources that are already available in the public domain. Asking questions like:

Who is the primary user impacted within the problem space?

What is the size and cost of the problem?

What is the impact-AKA who cares about this?

What are the existing solutions-what's working and what's not?

helped in shaping up the problem space and look in the correct direction.

5%

66%

Is DEBT the real problem?

Students are confident in paying of their debt once they land a job.

“Credit cards are helping me and spoiling me at the same time because my debt is increasing day by day, as I’ve already told you that it’s almost like 6 to 8000 dollars. If I get a job then hopefully I’ll clear all my debts.” - Participant 10

This reframed everything. The problem wasn't just impulsive spending, managing debt, or lack of awareness,

it was a how they perceived debt with a deeper dependence on uncertain future opportunities.

How Do You Stand Out In A Crowded Market?

Introducing Seize

Seize mobile application offers real-time insights on how every purchase could affect your credit score before you swipe your card!

We provide actionable financial insights and suggest actions, guiding students in making more informed financial decisions.